Total net inflows into Bitcoin and Ethereum spot ETFs totaled $552.9 million

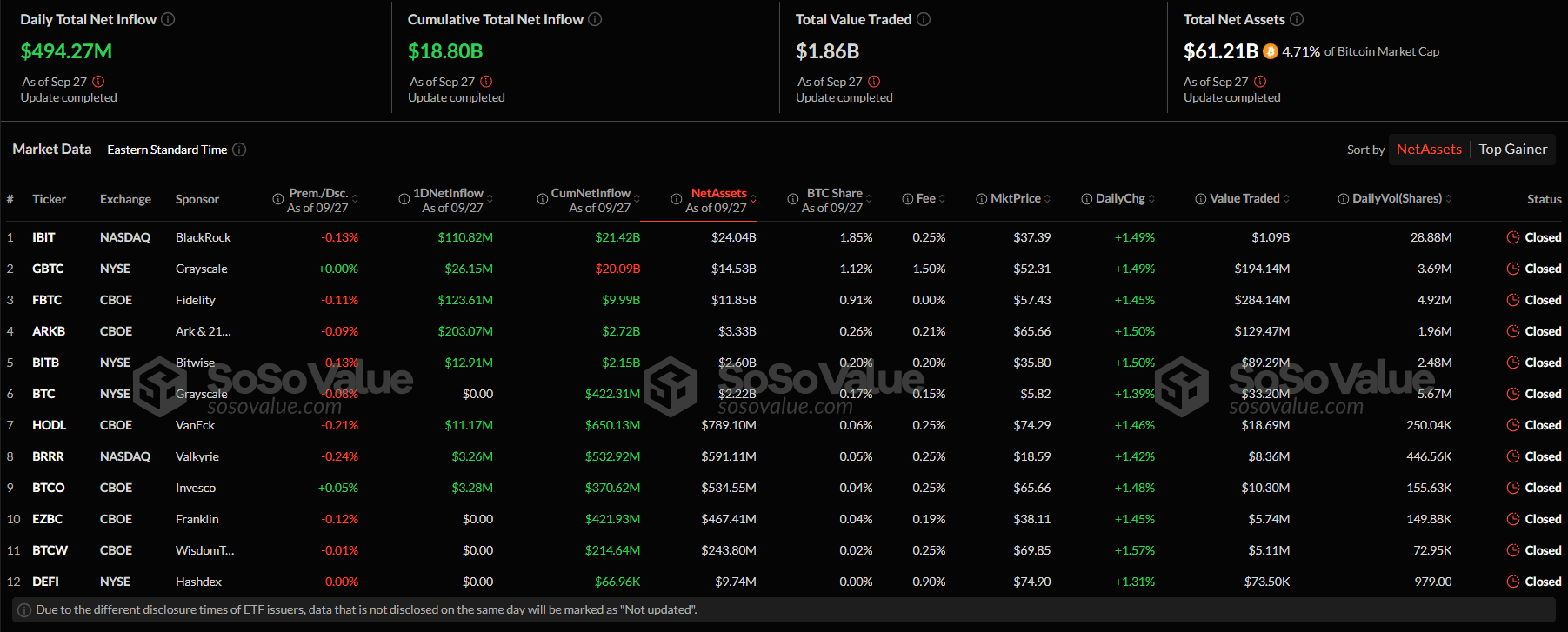

- On September 27, net inflows into spot Bitcoin ETFs exceeded $494 million.

- The leader in terms of the volume of financial investments was the crypto fund from Ark Invest and 21Shares — $203 million.

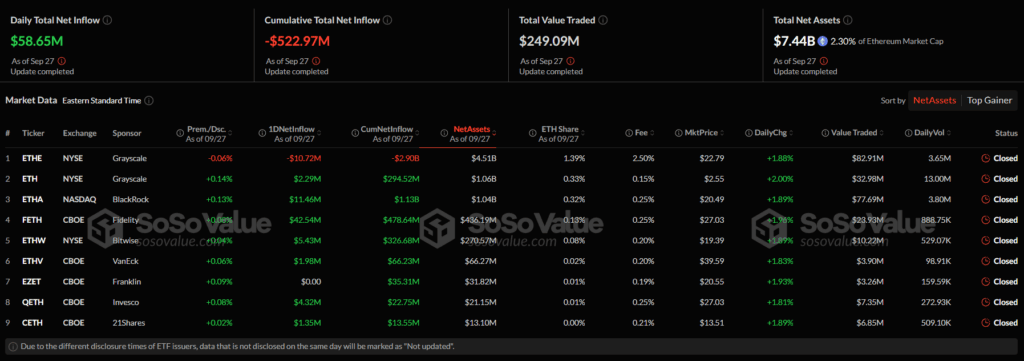

- Ethereum-based exchange-traded products generated a total of $58.65 million in volume during the past trading day.

On September 27, 2024, total net inflows into spot ETFs based on the first cryptocurrency and Ethereum reached $552.92 million, according to SoSo Value . The overwhelming majority of financial inflows came from investment products based on Bitcoin — $494.27 million.

The leader in terms of the amount of capital received in this asset class was the crypto fund from Ark Invest and 21Shares. The investment product under the ticker ARKB received $203 million, and the amount of funds under its management (AUM) is $3.33 billion.

In second place is the spot bitcoin ETF from Fidelity Investments with an indicator of $123.6 million. The AUM of this fund reached the mark of $11.85 billion.

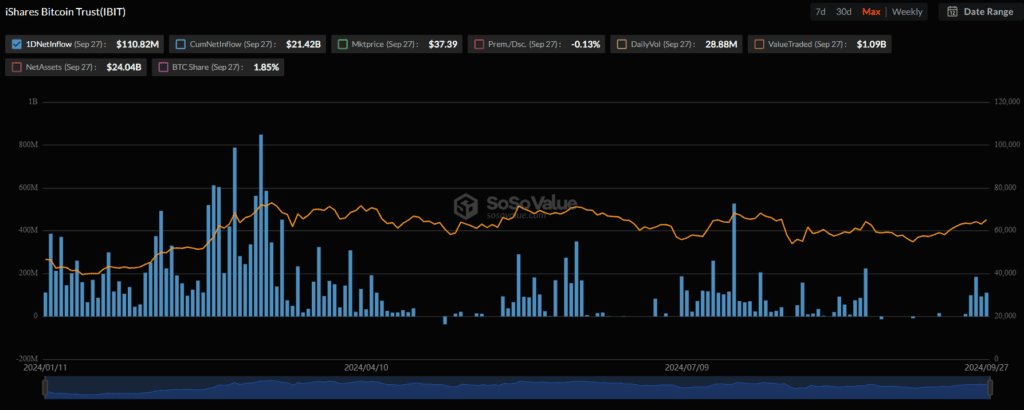

The third position was occupied by an investment product from the financial giant BlackRock. The cryptocurrency fund under the ticker IBIT recorded receipt of funds in the amount of $110.8 million. This spot Bitcoin ETF remains the leader in AUM with an indicator of $24.04 billion.

In addition, crypto funds received capital inflows from the following companies:

- Grayscale Investments (GBTC) - $26.2 million;

- Bitwise Asset Management (BITB) - $12.9 million;

- VanEck (HODL) - $11.2 million;

- Valkyrie (BRRR) - $3.3 million;

- Invesco and Galaxy Digital (BTCO) - $3.3 million.

The four remaining investment products based on the first cryptocurrency ended the previous trading day with zero inflow/outflow rates.

As for spot Ethereum ETFs, this segment received a net inflow of $58.65 million over the past 24 hours. The leader in terms of the amount of funds received here was the crypto fund from Fidelity — FETH. The investment product recorded financial inflows of $42.54 million.

The second place for the mentioned indicator is occupied by the investment product from BlackRock. The spot Ethereum-ETF under the ticker ETHA recorded an inflow of $11.46 million. It was followed by the crypto fund from Bitwise (ETHW) - $5.43 million.

In addition, four more exchange-traded products from the following companies received financial injections:

- Invesco and Galaxy Digital (QETH) - $4.3 million.

- Grayscale (ETH) - $2.3 million;

- VanEck (ETHV) - $2 million;

- 21Shares (CETH) – $1.4 million.

The only spot Ethereum ETF to see an outflow was Grayscale's ETHE investment product, which lost $10.7 million in the past trading day.