The Binance team presented a report on the cryptocurrency market for September. Experts noted an 8% increase in crypto market capitalization.

Experts from the analytical division of the Binance exchange — Binance Research — published a report on the cryptocurrency market for September 2024. They emphasized that the market capitalization grew by 8% over the month.

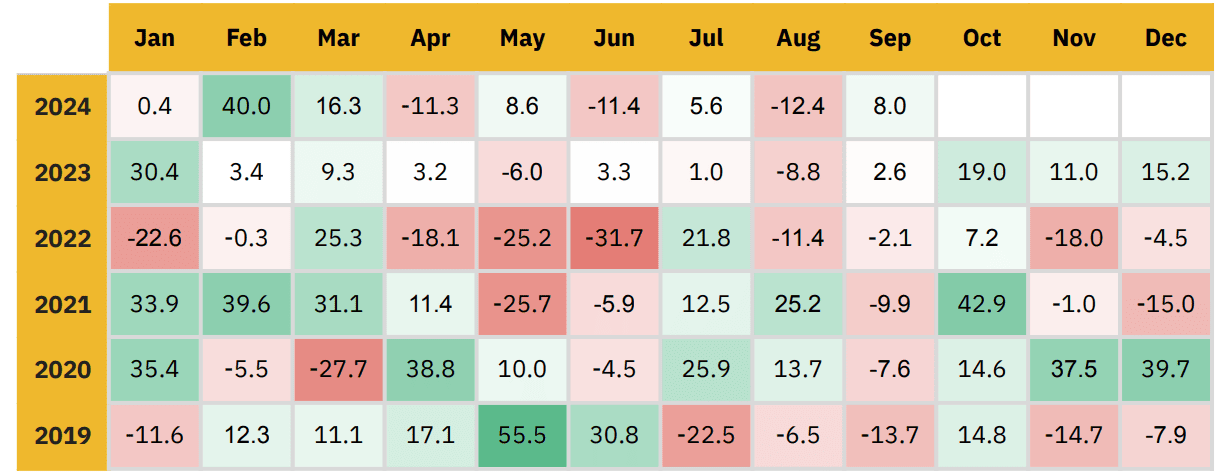

As you can see from the chart below, over the past five years, the crypto market has closed September in the black only twice.

Experts believe that the growth in capitalization was due to favorable global economic events. According to them, the decision of the US Federal Reserve to reduce the interest rate and positive labor market indicators contributed to the optimistic mood.

Analysts also noted the cut in interest rates by the People's Bank of China, which also injected 1 trillion yuan into the banking system to mitigate deflationary risks.

They added that the market's development in the near term remains dependent on economic reports and central bank policies.

The report notes that Avalanche (AVAX) showed the largest growth among the top 10 crypto assets in September — 20.1%. Experts noted the Wrapped Bitcoin (wBTC) asset, which maintains a strong position, having reached a record number of transactions, and its market share is more than 65%.

“This comes amid controversy over wBTC’s new multi-jurisdictional, multi-stakeholder asset custody model, as well as growing competition in the market,” Binance Research explained.

In addition, analysts reported an increase in Ethereum emissions by 0.74%, the highest in the last two years, which distances Ethereum from the status of Ultrasound Money . Experts attributed this growth to a decrease in network activity due to market conditions and increased competition from L2 solutions.

“Lower transaction fees and reduced coin burns have prevented Ethereum from remaining a deflationary asset, leading to positive changes in the daily supply,” the statement said.

Binance Research added that the total value of tokenized real-world assets (RWA) on the blockchain has reached a record high of over $12 billion. This growth is mainly due to the activities of fintech company Figure, the analysts added.

Binance previously published its Proof-of-Reserves report for September 2024.