Bitcoin mining difficulty may increase amid record low hashrate

- Hashprice remains near lows.

- Bitcoin mining difficulty is set to increase again, which could make things more challenging for miners.

- The latter risk operating on the brink of unprofitability with a hash price below $40 PH/s.

Bitcoin mining difficulty may increase in December 2025, despite a recent decline, while the hash price remains near historical lows.

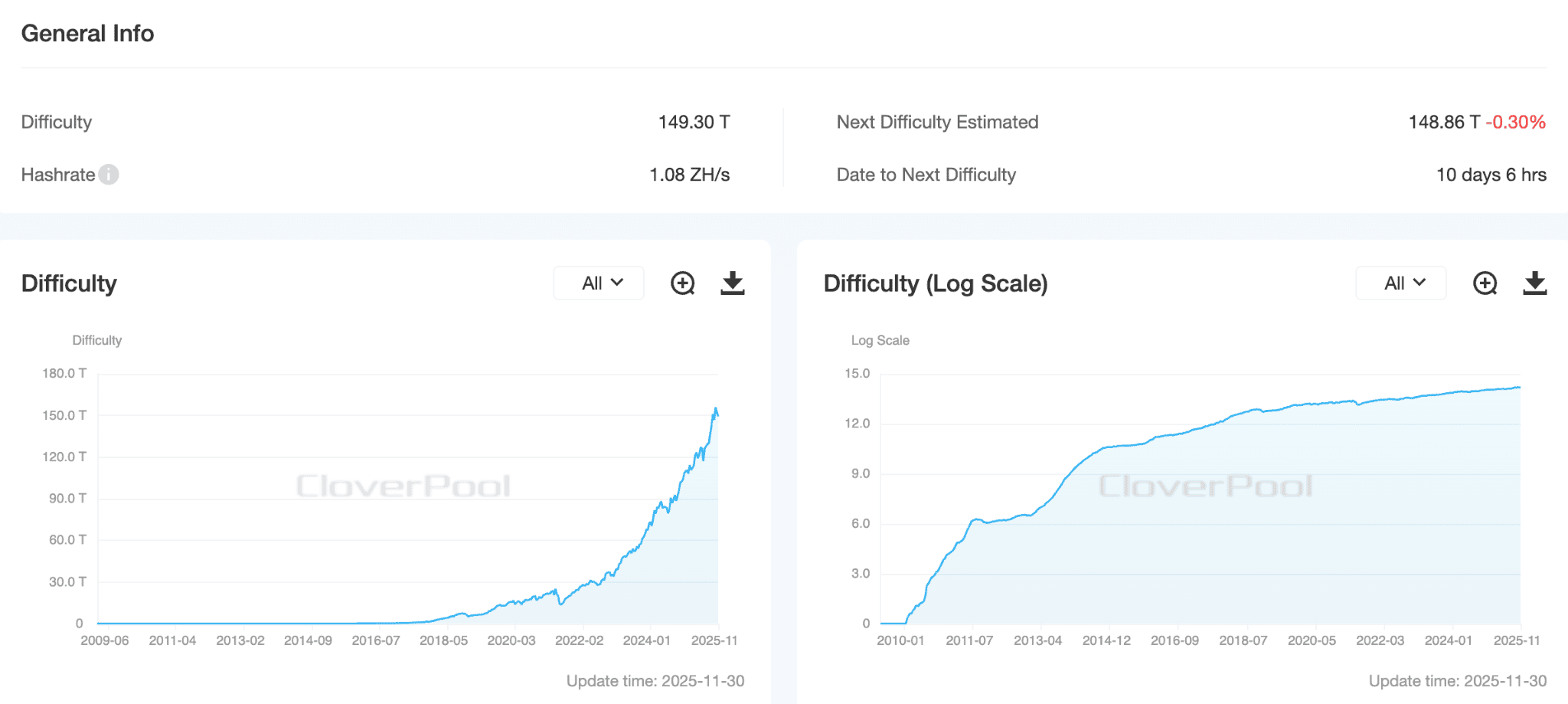

According to CoinWarz , the next difficulty adjustment is expected on December 10th at block 927,360, where the difficulty could rise from 149.30 trillion to 154.72 trillion at the time of writing.

The previous adjustment, which took place on November 27, reduced the difficulty from 152.2 trillion to 149.3 trillion, resulting in an average block time of about 9.97 minutes, slightly faster than the target of ten minutes.

Despite the reduction in difficulty, the hash price, which reflects the expected profitability of miners per unit of power, remains at extremely low levels.

According to the Hashrate Index , it's around $38.6 per PH/s per day at the time of writing, having recovered from a low of below $35 on November 21. For comparison, $40 PH/s is considered the breakeven point—the point at which miners must decide whether to de-energize their equipment or continue mining.

As a reminder, the mining industry continues to face a number of challenges, including Bitcoin miners' debt , which has risen 500% over the past 12 months to $12.7 billion, potential taxation of mining companies in New York, and geopolitical tensions between the US and China, which could impact equipment supply chains.