Hashed: Stablecoins and AI lay the foundation for a new protocol economy for 2026

- Hashed has published a report for 2025.

- In it, the company analyzed regulation, stablecoins, the impact of AI, and the institutional crypto market.

- As for the future of the crypto industry, she believes that the protocol economy will define 2026.

In 2025, the cryptocurrency market experienced not another cycle of volatility, but a profound structural alignment. This is the assessment made by Hashed in its policy paper, "The Protocol Economy: Hashed Thesis 2026," which summarizes the industry's transformation and outlines key directions for 2026.

According to the fund's team, the crypto ecosystem is gradually moving away from speculative narratives and beginning to operate according to the logic of the real economy—through infrastructure, usage, and financial flows.

In his foreword, Hashed CEO and Managing Partner Simon Kim emphasized that the key feature of this year was not price volatility, but rather the market's alignment with fundamentals.

"The industry has moved away from the noise and returned to the basics. Narratives have come and gone, but the key question remains: what actually works?" he noted.

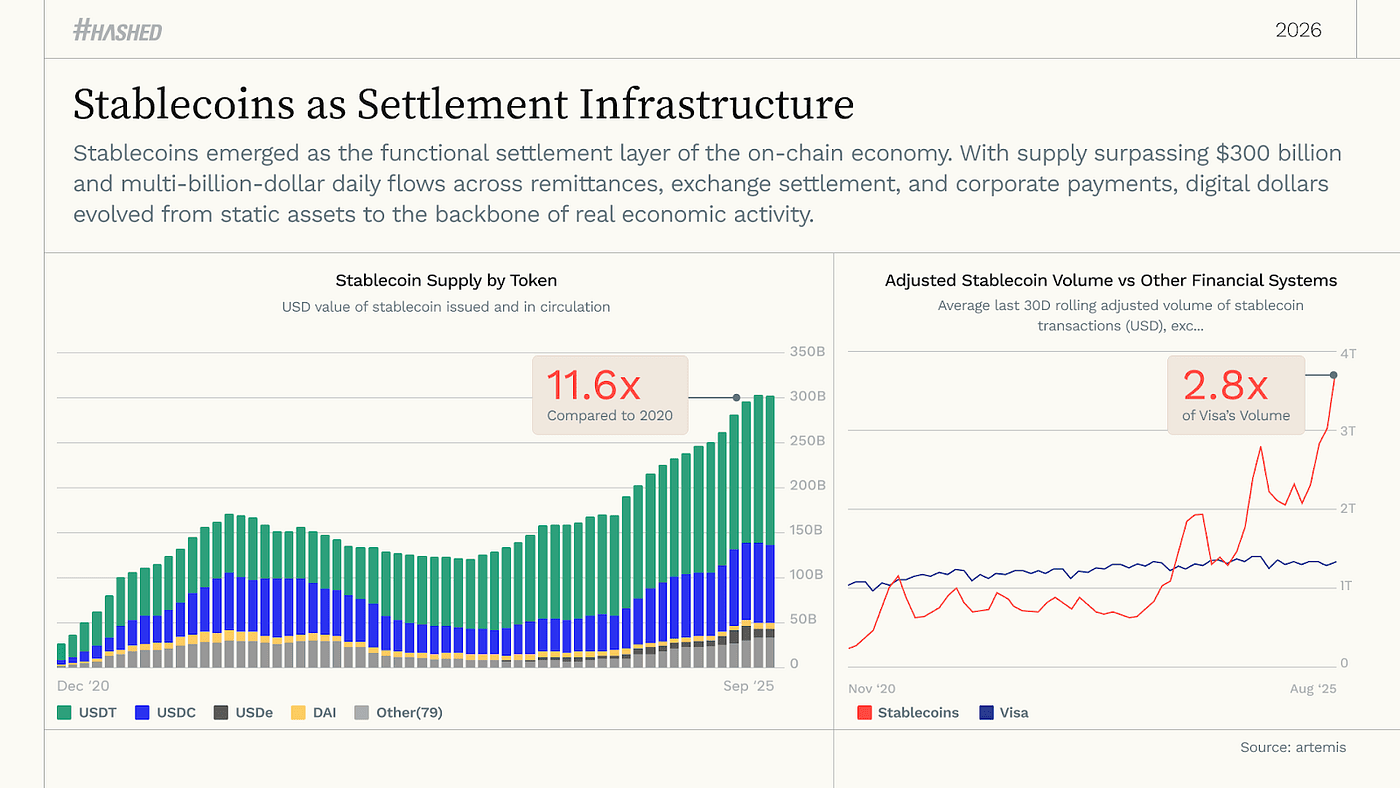

It was in this context, he said, that it became clear that stablecoins were becoming the first fully-fledged element of digital financial infrastructure to reach a "breakthrough point."

The Hashed team emphasized that regulatory approaches varied in the US, Korea, Japan, the Middle East, and Southeast Asia, but the overall trend was unanimous—an unprecedentedly positive attitude toward stablecoins.

They are no longer perceived as a liquidity experiment, but are becoming a practical settlement layer for cross-border payments, corporate treasuries, and consumer transactions. "Digital money with programmable trust" is beginning to integrate into real economic flows.

According to the report, artificial intelligence (AI) plays a significant role in this transformation. While stablecoins provide the financial foundation, AI determines who uses them and how. Economic activity is increasingly shifting from humans to autonomous agents capable of independently conducting transactions, coordinating actions, and completing tasks.

According to Hashed, the basic unit of the digital economy is gradually becoming not users, but agents, and stablecoins are their standard payment instrument.

2025: The Year the Market Comes of Age

In its annual review, Hashed noted that 2025 marked a turning point: the competition of ideas gave way to competition of execution. Fewer new projects were launched, many experiments disappeared, but those teams that remained were able to prove their value through real users, volumes, and revenue. The market stopped asking, "Is this new?" and started asking, "Does this work consistently?"

Technological progress has created the necessary basis for this:

- Ethereum has reduced costs and improved user experience through zk-rollups, EIP-4844, and the development of account abstraction;

- Solana has proven the viability of a monolithic architecture by consistently running over 50,000 TPS;

- Internetworking protocols such as LayerZero and CCTP have created new expectations regarding settlement finality.

As a result, the notion of crypto infrastructure as “slow and expensive” has become significantly less relevant.

Against this backdrop, stablecoins have established themselves as a functional payment layer in the on-chain economy. Their supply has exceeded $300 billion, with daily flows reaching billions of dollars in transfers, exchange settlements, corporate payments, and treasury transactions.

The emergence of yield-generating stablecoins has ushered in a new model—"income-generating digital money"—transforming it from an intermediary into a starting point for capital allocation.

Hashed's Election Strategy: Where They Invested and Where They Abstained

Despite the stablecoin boom, Hashed consciously eschewed most centralized or bank-backed issuers. According to the fund's assessment, many of them lacked sufficient regulatory depth or a sustainable business model. Only about 13% of global corporations that declared interest in stablecoins actually used them.

The Bastion project was an exception, focusing not on the token itself, but on a full-fledged infrastructure: regulated issuance, custody, on/off ramps, and compliance within the New York trust structure.

A similar selectivity has emerged with regard to new L1 blockchains. Although network launches have become technically easier, Hashed believes that the key constraint is no longer throughput, but long-term relevance and the ability to integrate with real-world systems. This is why the fund has supported only a few projects, including Rialo, which expands blockchain interoperability with external data.

In the AI and cryptocurrency space, Hashed avoided hyped solutions, focusing on infrastructure for autonomous agents. As the report states:

"AI and cryptocurrencies are becoming reality primarily through payments, not through computing."

As a result, the fund has deepened its involvement in Kite AI, which builds cryptographic identities, programmable payment policies, and microcomputing in stablecoins.

RWA, private credit, and the new role of stablecoins

Hashed has also placed significant emphasis on the tokenization of real-world assets (RWAs). With Treasury yields rising and the era of zero interest rates ending, capital has begun to shift from high-risk speculation to products with predictable cash flows.

However, the key value of RWAs is not in profitability, but in the fact that they are the first truly on-chain processes directly linked to the real economy: B2B payments, trade finance, treasury and settlement operations, and so on.

Tokenized private lending stands out, calling Hashed the first scalable on-chain yield marketplace. Tokenization reduces operating costs, increases transparency and liquidity, and the growing supply of stablecoins creates stable demand for such instruments.

As a reminder, financial company WisdomTree recently tokenized a private lending fund, while FIS and Intain launched the Digital Liquidity Gateway platform on Avalanche, which allows banks to tokenize loans as NFTs.

Regulatory convergence as a basis for institutional entry

The report details the regulatory shifts of the year that paved the way for the institutional integration of cryptoassets. In the US, the passage of the GENIUS Act solidified a federal framework for stablecoins, linking them to Treasury securities reserves.

At the same time, crypto asset custody requirements were relaxed, paving the way for banks and large asset managers. South Korea implemented a dual regulatory model, while the UAE strengthened oversight through the Virtual Asset Regulatory Authority (VARA) and the Abu Dhabi Financial Services Regulatory Authority (FSRA), facilitating the growth of licensed activity.

Hashed concluded that 2025 marks the transition from fragmented regulation to systemic design. The next stage is regulation of infrastructure, not individual tokens, and this will determine global competition for liquidity.

A look into 2026

Hashed believes that 2026 will be the year when applications, not blockchains or tokens, will drive the industry's development. Stablecoins will serve as a universal liquidity layer, AI agents will act as real-time demand processors, and RWAs will act as a bridge to the off-chain economy.

“Patience is more important than speed, and structure is more important than history,” Kim concludes, emphasizing that competition is shifting from narratives to long-lasting economic primitives.